Capital Structured for Execution

Maritime investment

and execution platform

Structure. Execute. Repeat.

Commenda Capital originates shipping investment projects, structures the capital behind them, and remains responsible for execution. Our team works across traditional shipping and next-generation maritime infrastructure, applying the same discipline to both: clear risk allocation, aligned capital, and meticulous execution.

Deal Origination

We source and develop investment opportunities across shipping and maritime infrastructure.

Capital Structuring

We design capital around market and maritime realities — cycles, risk profiles, and execution requirements.

Execution Retained

We remain exposed beyond financial close, with decision-making authority and accountability through operation.

Flagship Partnership

Commenda Capital is the exclusive capital and project partner to DRIFT Energy, a next-generation maritime energy platform.

Who We Are

Commenda Capital is built on a simple principle: if capital cannot earn a return, change does not scale.

Shipping is entering a period of disruption. New technologies, new energy systems, new operating models—driven by decarbonisation and new regulatory demands. The ambition is real. So is the risk. Most ideas never leave the drawing board. Not because they lack vision, but because they cannot be financed, built, or operated in the real world.

Our role is to bridge that gap.

We connect ambitious maritime innovation with disciplined capital, and take responsibility for turning ideas into investable, executable projects. Without credible returns for investors, nothing moves. With the right structure, everything does.

Commenda Capital is led by Ulrik Uhrenfeldt Andersen and Michael Ebbe Hansen.

Commenda Meaning

The Meaning of Commenda

Commenda Capital takes its name from the commenda, the earliest maritime investment structure, formalised in medieval Venice to finance long and uncertain sea voyages. This structure financed Marco Polo. It financed the Age of Exploration.

The commenda was, in effect, the world’s first maritime special-purpose vehicle. One party provided capital. Another took responsibility for execution. Profits shared, liability defined, risk structured.

The word commenda derives from the Latin commendare — to entrust. Capital doesn’t move history by intention. It moves when it is entrusted, protected, and rewarded.

INVESTMENT

PHILOSOPHY

Commenda Capital exists to bridge vision and investability. Returns are the test, not the intention.

Innovations and disruptions matter when they change economics: asset values, operating costs, competitive positioning. The same applies to conventional shipping. Opportunity comes from timing, structure, and execution.

We don’t pick sides between old and new.

We back projects that are financeable, executable, and resilient across cycles. In some cases, opportunity lies in innovation and new technology. In others, it lies in timing, structure, and disciplined execution within established segments. The source of return may differ. The discipline does not.

Flagship Partnership

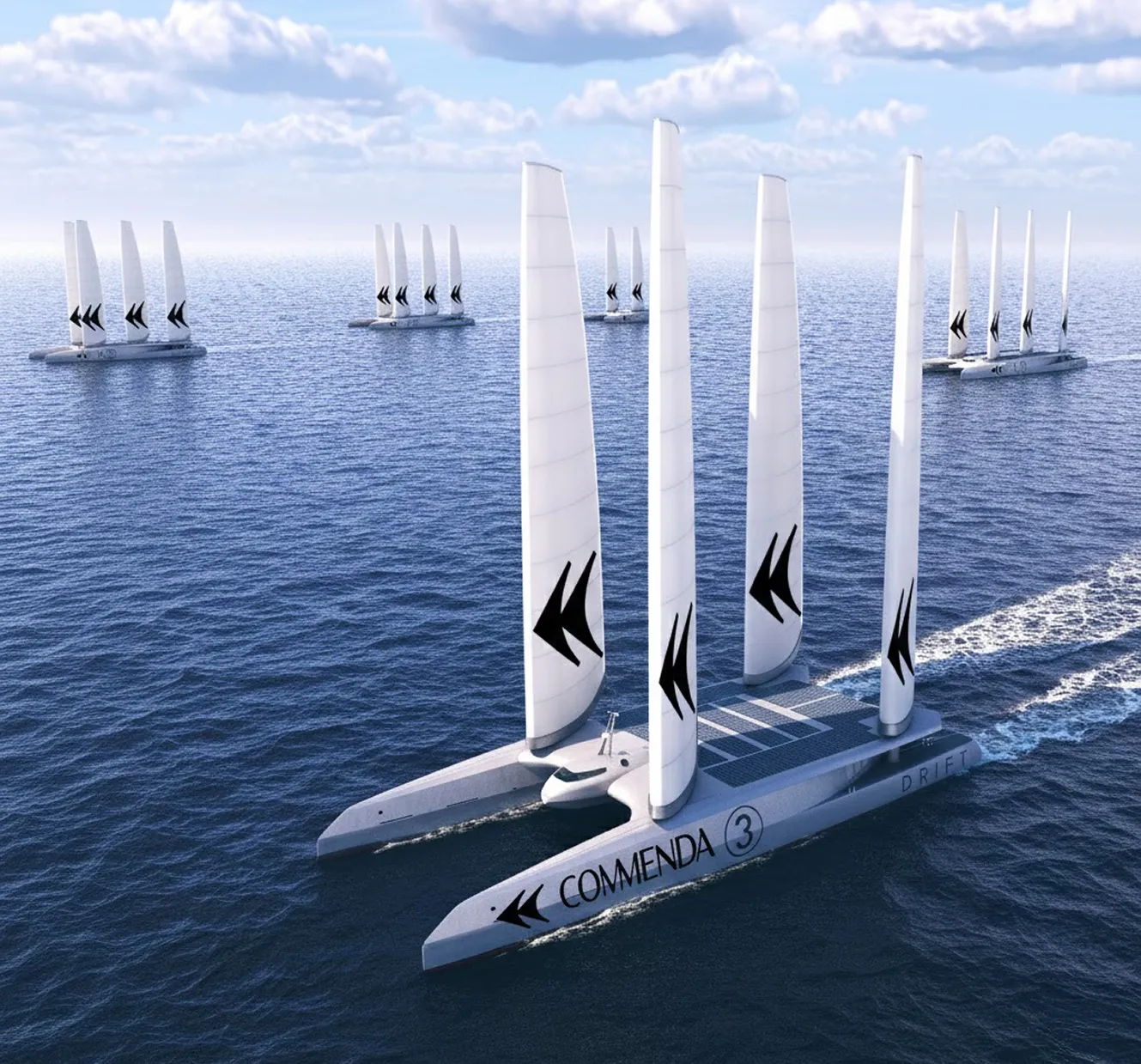

Commenda Capital is the exclusive capital and project partner to DRIFT Energy.

DRIFT Energy is a first-of-kind maritime energy platform developing AI-guided vessels that harvest wind at sea and convert it into transportable energy, including green hydrogen. The system is designed as mobile offshore energy infrastructure, delivering energy to demand without dependence on fixed locations or onshore grids

Commenda structures the projects, arranges the capital, and retains execution responsibility. DRIFT focuses on technology development and system integration.

Clear separation of roles. Aligned incentives. Shared accountability. DRIFT represents the type of capital-intensive, execution-led project Commenda Capital is built to deliver.

MODEL

IN

ACTION

As DRIFT Energy progresses from prototype toward commercial deployment, Commenda Capital’s role is to structure the transition from development to scale.

The partnership is designed to evolve as technical performance is demonstrated and execution risk is reduced. Structures adapt as projects mature and capital broadens. Execution determines the pace.

2024

Demonstrator proven at sea (TRL-6)

2026

First commercial vessel in build

2028

First flotillas in operation

2030

Scaling across multiple markets and regions

Management Team

Commenda Capital is led by senior shipping and capital markets operators with experience across cycles, assets, and complex project execution.

Ulrik Uhrenfeldt Andersen

CEO / MANAGING PARTNER

Former CEO of Golden Ocean Group and Avance Gas. 20+ years in shipping leadership through fleet growth, market cycles, and the energy transition.

Michael Ebbe Hansen

CIO / MANAGING PARTNER

Founder of Copenhagen Marine Capacity. Maersk-trained. 15+ years structuring maritime investments across chartering, S&P, and financial advisory.